QDTE stock is getting a lot of attention from investors. Many people want to know if QDTE stock is a good choice for the future. Some believe it has great potential, while others are not sure. If you are thinking about investing, learning more about it first is essential.

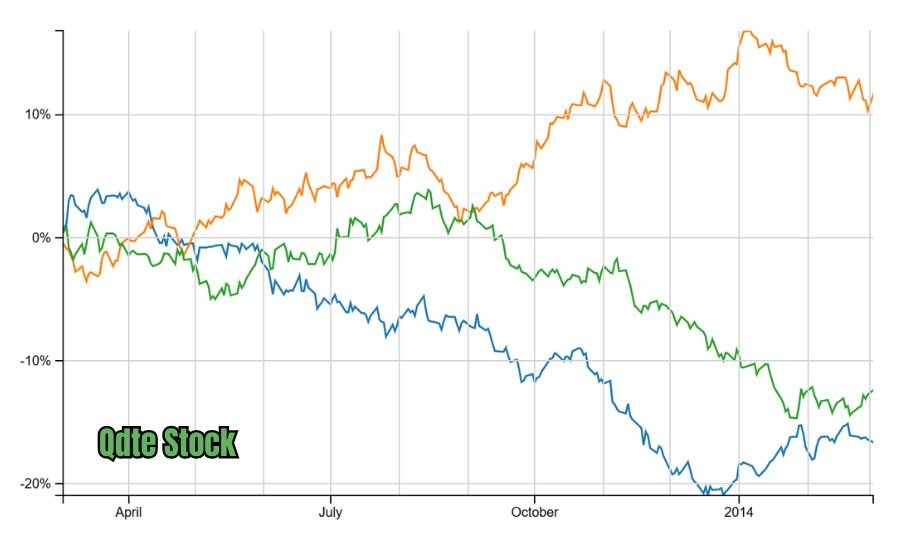

Stocks go up and down, and QDTE stock is no different. The price can change based on company news, market trends, and investor interest. Understanding these factors can help you make better decisions. Let’s examine what makes QDTE stock trends interesting and whether it might be a wise investment.

QDTE Stock: What Makes It Special?

QDTE stock is gaining attention in 2024. Many investors are looking at this stock because of its potential. Companies that show strong growth and innovation often attract interest, and this one is no different.

Investors want to know what makes QDTE stock unique. Some factors include the company’s leadership, financial strength, and new projects. If the company continues to expand, it could be a strong choice for the future.

Understanding market trends is also essential. QDTE stock follows the stock market’s ups and downs. Watching industry changes can help investors decide when to buy or sell.

Why Are Investors Talking About QDTE Stock?

Many investors are interested in QDTE stock valuation this year. It has excellent potential for future growth. When a stock becomes popular, more people start watching it closely.

The stock market can be unpredictable. Some investors like to take risks, while others prefer safer options. It has caught attention because of recent financial reports and market changes.

Experts suggest researching before making any decision. Looking at past performance and company goals can help investors understand if this stock is right for them.

Is QDTE Stock a Good Investment for Beginners?

New investors often look for easy-to-understand stocks. It might be an option for those starting in the stock market. However, it is essential to learn about risks and rewards before investing.

Buying stocks requires patience. Prices go up and down, and new investors need to stay calm. Some people see quick gains, while others wait for long-term growth.

Education is key when investing. Reading about QDTE stock and market trends can help beginners make better choices. Knowing when to buy and sell is an important skill.

QDTE Stock Price: What Affects It?

Stock prices change all the time. It is no different. Many factors can affect its price, including company news, industry trends, and investor demand.

Market conditions play a significant role in stock prices. If the overall market is strong, many stocks go up. However, if the market is weak, prices can drop. Investors watch economic trends to predict these changes.

Company performance also matters. When a company does well, stock prices often rise. If earnings reports are not good, prices may fall. Watching financial updates can help investors stay informed.

How to Buy QDTE Stock the Right Way

Buying stocks can be simple if you follow the proper steps. It is available through stock markets, and investors can purchase shares online.

Choosing a reliable stockbroker is essential. Some brokers offer lower fees, while others provide better research tools. Picking the right one can make a big difference.

Timing matters in stock buying. Some people buy when prices are low, hoping they will go up. Others wait for strong trends before making a move. Research helps in making wise choices.

QDTE Stock Risks: What You Should Know

All investments come with risks, and QDTE stock news is no exception. Prices can change quickly, and sometimes, investors lose money.

Stock market conditions affect risk levels. When markets are unstable, stock prices move more than usual. Observing trends can help investors make better decisions.

Diversification reduces risk. Instead of investing in just one stock, many people spread their money across different companies. This way, losses in one stock can be balanced by gains in another.

Will QDTE Stock Go Up in the Future?

Predicting stock prices is not easy. Some analysts believe QDTE stock valuation has strong growth potential. Others think market conditions will decide its future.

Stock performance depends on many factors. A company with strong leadership and good products often sees stock growth. Investors consider company strategies before making decisions.

Economic trends also play a role. If the economy is growing, many stocks rise. If there is a slowdown, stock prices may fall. Keeping track of financial news helps investors stay prepared.

How QDTE Stock Compares to Other Stocks

Investors like to compare stocks before buying. QDTE stock news is often compared to similar companies in the same industry. Comparing these companies can help you make better choices.

Each stock has strengths and weaknesses. Some companies grow fast, while others provide steady earnings. Understanding these differences can guide investment strategies.

Historical performance is sound. If QDTE stock has grown well in the past, some investors may believe it will continue. Others prefer looking at plans before making a decision.

Tips for Investing in QDTE Stock Safely

Here are some essential points to help you invest in QDTE stock wisely:

1. Set a Budget and Stick to It

- Do not invest all your money in one stock.

- Invest only what you can afford to lose.

- Avoid borrowing money or using credit for investments.

- Diversify your investments to reduce risk.

2. Do Proper Research

- Learn about QDTE stock and the company behind it.

- Read financial reports and expert opinions.

- Check past stock movements to understand trends.

- Compare it with other stocks in the same industry.

3. Watch the Market Trends

- Stock prices go up and down, so stay updated.

- Follow financial news and stock market updates.

- Check how the economy is performing.

- Study stock charts to predict price movements.

4. Have a Long-Term Mindset

- Stocks may not rise overnight, so be patient.

- Avoid panic selling when prices drop.

- Do not buy more stocks just because prices are rising fast.

- Focus on long-term growth instead of quick profits.

5. Avoid Emotional Decisions

- Stock prices can be unpredictable, so stay calm.

- Follow a planned strategy instead of acting on fear or excitement.

- Do not let short-term losses discourage you.

- Think logically before buying or selling stocks.

6. Invest Regularly Instead of All at Once

- Investing in small amounts over time reduces risk.

- It helps you buy stocks at different prices.

- This method is called “dollar-cost averaging.”

- It prevents panic if prices drop suddenly.

7. Check fees

- Some brokers charge fees for buying and selling stocks.

- Check if there are any hidden costs before investing.

- Choose a platform with low or no trading fees.

- Understand tax rules for stock profits in your country.

8. Follow Expert Advice

- Read expert analysis before making decisions.

- Join stock market forums or groups for discussions.

- Learn from experienced investors to avoid common mistakes.

- Do not unthinkingly follow rumours or social media trends.

9. Use a Secure Trading Platform

- Choose a trusted broker or stock trading app.

- Make sure your account is safe from hackers.

- Enable two-factor authentication for extra security.

- Avoid sharing your investment details with others.

10. Stay Consistent and Keep Learning

- Stock investing requires continuous learning.

- Keep updating your knowledge about QDTE stock.

- Learn from both gains and losses.

- Stay disciplined and follow your investment plan.

Latest News and Updates on QDTE Stock

Keeping up with stock news is helpful. QDTE stock updates can provide vital information for investors. News about the company, industry, and economy all affect stock prices.

Company announcements can cause price changes. When a company releases good earnings reports, stock prices often rise. Bad news can have the opposite effect.

Watching expert opinions is helpful. Some analysts share price predictions, which help investors understand stock movements. Staying updated makes investment decisions easier.

Understanding Market Trends for QDTE Stock

Market trends help predict stock movements. QDTE stock follows industry patterns, making it essential to understand these trends.

Supply and demand affect prices. When more people buy a stock, prices go up. If more people sell, prices drop. Investors use trend analysis to plan their moves.

Economic changes impact stocks. Interest rates, inflation, and company growth all play a role. Studying market trends helps investors make informed choices.

Should You Hold or Sell QDTE Stock?

Deciding whether to hold or sell a stock is essential. QDTE stock may be a good long-term investment, but knowing when to sell is just as important.

Stockholders watch price trends. If a stock keeps growing, some investors hold onto it. Others prefer to sell when they reach their target profit.

Setting an exit strategy helps. Some investors sell part of their stocks and keep the rest. Others wait for market signals before making a move. Planning leads to better decisions.

Conclusion

Investing in QDTE stock can be a good choice, but it is essential to be thoughtful and careful. Researching, setting a budget, and watching market trends can help you make better decisions. It is always best to invest with a long-term mindset and not rush into buying or selling stocks too quickly.

Every investor makes mistakes, but learning from them will improve your performance. Staying patient, avoiding emotional decisions, and using a safe trading platform will secure your investment.

Read More: Rome-sentinel-death-notices

FAQs About QDTE Stock

Q: What is QDTE stock?

A: QDTE stock is a type of stock that belongs to a company. It is traded in the stock market and its price increases.

Q: Is QDTE stock a good investment?

A: It depends on your goals. Research the company, check market trends, and decide if it fits your investment plan.

Q: How can I buy QDTE stock?

A: You can buy QDTE stock through a stockbroker or a trading app. Create an account, deposit money, and place your order.

Q: Is investing in QDTE stock risky?

A: Yes, all stocks have risks. The price can go up or down, so invest carefully and not use money you can’t afford to lose.

Q: How long should I hold QDTE stock?

A: It depends on the market. Some investors hold for a long time, while others sell quickly. A long-term plan is often safer.

Q: Can I lose money in QDTE stock?

A: Yes, if the price drops, you may lose money. That’s why it’s essential to research and invest wisely.

Q: What is the best time to buy QDTE stock?

A: There is no perfect time. However, a good strategy is to watch market trends and buy when prices are low.